In the rapidly evolving fintech landscape, acquiring new users isn’t just about numbers — it’s about building trust, fostering engagement, and driving meaningful actions that lead to long-term retention and growth. Over the past few years, interest rate hikes by central banks worldwide have significantly impacted fintech companies. These economic changes have led to a slowdown in venture capital funding and shifts in consumer behavior. As a result, fintech companies have increasingly moved towards tighter budgets focused on profitability. Additionally, fintech companies have grappled with increasingly saturated advertising channels that have driven up customer acquisition costs (CAC) significantly.

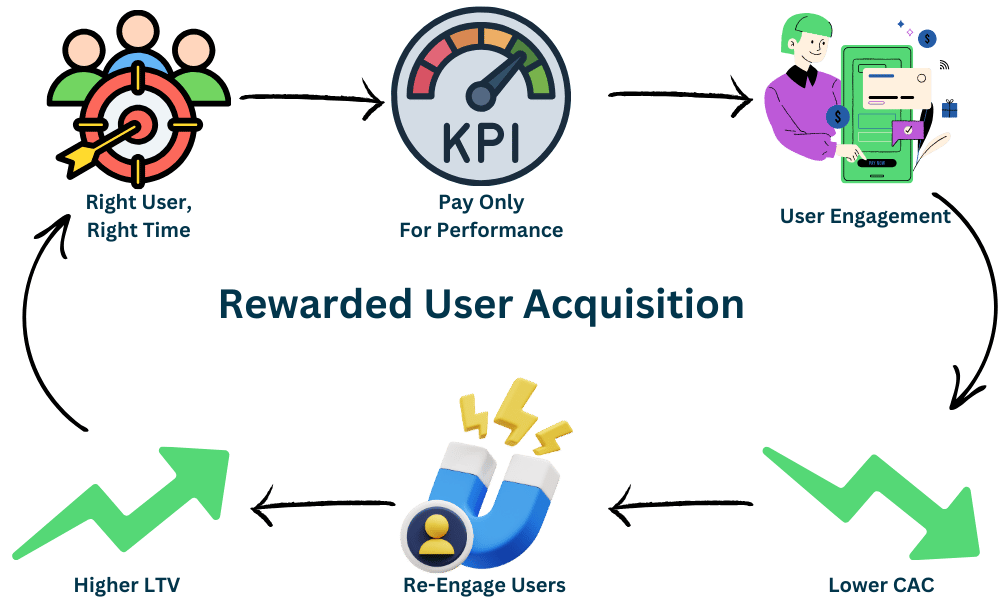

Enter rewarded user acquisition (UA), a performance marketing strategy that enables fintech companies to cost-effectively acquire engaged users who contribute to a higher return on ad spend (ROAS) over time. By offering users incentives, rewarded UA not only attracts new users but also encourages deeper engagement and loyalty, effectively addressing the challenges of high CAC and low LTV.

In this article, we’ll explore how fintech advertisers can leverage rewarded UA to overcome industry-specific challenges and achieve more sustainable growth.

If you’re new to rewarded UA, please check out Winning Rewarded UA Strategies for 2024 and Beyond to familiarize yourself with the basics.

Table of Contents

What Are Good CAC and LTV Benchmarks for Fintech Companies?

In the late 2010s and early 2020s, the fintech industry experienced a funding boom, with unprecedented amounts of capital directed toward acquiring new users. This influx of investment led to a significant increase in CAC, which remain high due to intense competition from both large fintech players and traditional banks expanding their digital offerings.

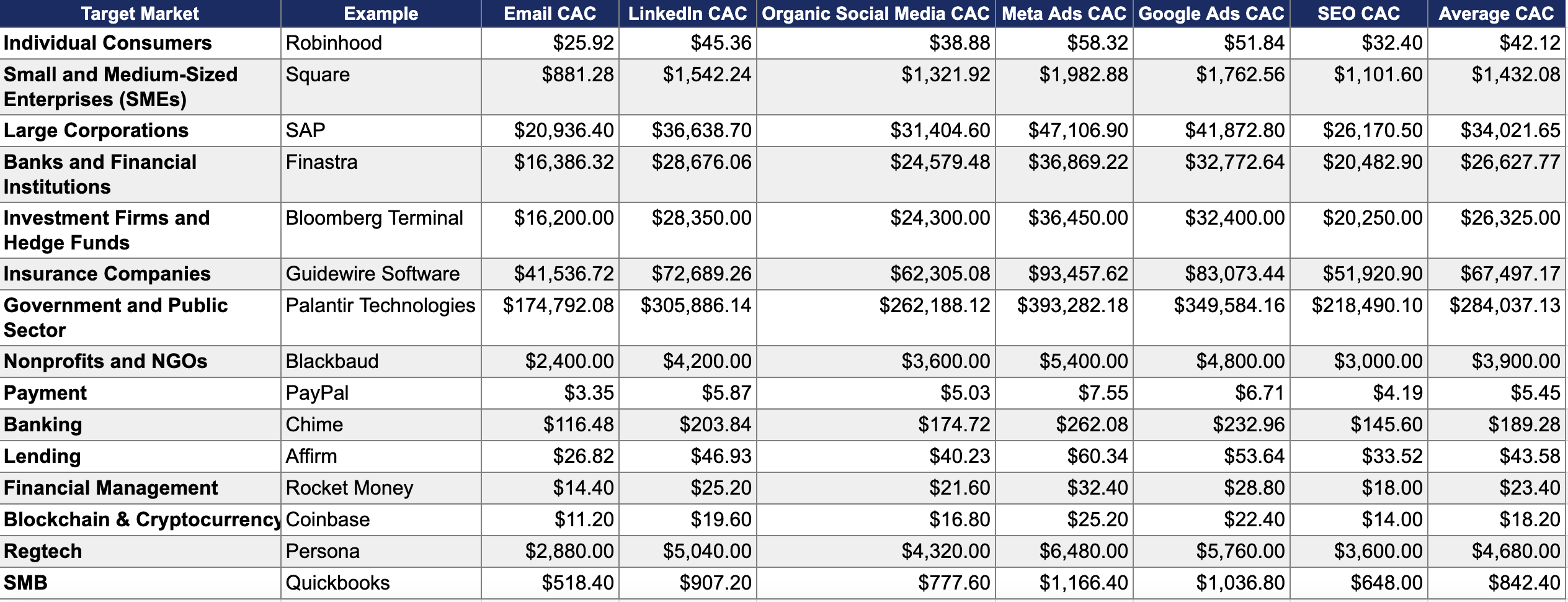

While each fintech company ultimately has its own unique CAC and Lifetime Value (LTV) metrics, it’s helpful to compare against industry benchmarks to gauge performance. Below is a benchmark of CACs by category leaders and acquisition channels for 2023:

As a general rule of thumb, a healthy business shoulnad aim for an LTV:CAC ratio of at least 3. An LTV:CAC ratio of at least 3 indicates that for every dollar spent on acquisition, you earn three dollars over the customer’s lifetime, ensuring profitability and sustainable growth.

If the LTV:CAC ratio is too low, consider the following strategies:

Lower CAC:

- Utilize Performance Marketing Channels: Target cost-effective channels like rewarded user acquisition (UA) to reach engaged users.

- Optimize Ad Sets and Creatives: Refine your messaging and visuals to improve ad effectiveness.

- Explore New Channels: Test additional marketing channels to diversify your acquisition strategy, including organic/viral methods like SEO and referral programs.

- Address Funnel Drop-Off Points: Analyze where users disengage and optimize those stages to improve conversion rates.

Increase LTV:

- Reduce Churn: Increase ad spend on marketing channels/sources that have higher LTV and reduce spend on marketing channels/sources that have lower LTV. In addition, implement retention strategies such as personalized messaging, rewards programs, or fast customer support.

- Upsell Additional Services: Offer complementary products or premium features to increase customer spend.

- Adjust Pricing Strategies: Consider value-based pricing or tiered subscription models to boost revenue.

- Refine User Targeting: Focus on acquiring high-value customers that meet your ICP and are more likely to utilize your services extensively.

If your fintech’s CAC is already below industry averages but the CAC:LTV ratio is less than 3, it’s best to focus on increasing LTV. Conversely, if your CAC is high relative to industry benchmarks, refining your marketing strategies to reduce CAC should be a priority.

Why Rewarded UA Drives Fintech ROAS

Rewarded user acquisition (UA) is a powerful performance-based marketing strategy that enables fintech companies to pay only for specific user actions. By focusing on meaningful engagement rather than impressions or clicks, rewarded UA allows you to optimize key performance indicators (KPIs) cost-efficiently, ultimately boosting your Return on Ad Spend (ROAS) with less on-going optimization effort.

Optimize Marketing Budget Towards Active Users

In traditional advertising campaigns, such as Google Ads, marketers invest significant resources in optimizing text, images, videos, keywords, and other ad params to lower the cost per acquisition (CPA). This process often involves continuous adjustments and will still result in paying for clicks or impressions that don’t convert into active users. While Google Ads provides extensive reach, it doesn’t guarantee engagement from the users who matter most to your fintech business.

Rewarded UA changes this dynamic by allowing you to set specific criteria for what constitutes an active user—such as completing an account registration, verifying identity, and making an initial deposit. You only pay when users meet these predefined actions, ensuring that your marketing budget is spent exclusively on acquiring users who are more likely to deliver long-term value. This performance-based approach can lead to a lower CAC and a higher LTV, maximizing your ROAS.

Demographic Synergy

Rewarded UA platforms attract users who are tech-savvy, financially motivated, and open to exploring new digital solutions—traits that align closely with the target demographics of fintech companies.

This demographic synergy means your marketing efforts are more likely to reach individuals who are not only interested in financial products but also willing to engage deeply with innovative services. By tapping into this receptive audience, you increase the likelihood of acquiring users who will actively utilize your fintech solutions, thereby enhancing engagement and boosting LTV.

Lowering CAC and Increasing LTV

By leveraging rewarded UA, fintech companies can reduce their CAC. Since you incur costs only when a user completes a desired action—such as downloading your app, signing up, and making an initial transaction—you eliminate spend on users who show no real interest. This efficiency leads to lower overall acquisition costs.

Moreover, rewarded UA helps increase LTV by attracting users who are more likely to remain engaged with your platform. Offering the right reward encourages users to explore more features of your app or service, fostering loyalty and increasing their lifetime value. For example, a fintech app might offer rewards for users who not only make a deposit but also set up a recurring deposit. This strategy not only secures new users but also promotes ongoing engagement, directly impacting LTV.

By continually refining your rewarded UA campaigns—adjusting incentives based on user behavior—you can concentrate on attracting high-value users who contribute more revenue over time, thus maximizing your ROAS.

Building the Right Rewarded UA Campaign for Your Fintech Company

Designing the right rewarded user acquisition (UA) campaign is crucial for maximizing your fintech’s growth and return on ad spend (ROAS). Among the various campaign formats, Cost Per Engagement (CPE) campaigns stand out as the most effective for fintech companies. CPE campaigns allow you to pay only when users perform specific, valuable actions, ensuring that your marketing budget directly contributes to meaningful user engagement and revenue generation.

Single-Reward CPE Campaigns

Single-reward CPE campaigns focus on a action or a single set of required steps you want users to complete. For fintech companies, this action could be:

- Signing Up for an Account: Attracting new users to your platform.

- Completing KYC Verification: Ensuring compliance and security.

- Making an Initial Deposit: Jumpstarting user engagement with your financial services. The user is rewarded after the initial deposit.

Advantages:

- Simplicity: : Easy to implement and track, allowing for quicker campaign launch.

- Focused ROI Measurement: Directly link marketing spend to a specific KPI.

- Cost-Effective for Specific Goals: Ideal for campaigns with a singular objective.

When to Use:

- Launching a new app or feature where immediate user action is desired.

- Driving a specific metric that is critical to your growth strategy.

While single-reward campaigns are effective for targeting specific actions, multi-reward CPE campaigns can take user engagement to the next level by encouraging continued interaction.

Multi-Reward CPE Campaigns

Multi-reward CPE campaigns involve setting multiple payable actions, creating a pathway that encourages users to engage more deeply with your app or service.

Examples of Actions:

- First Reward: User signs up and completes KYC verification.

- Second Reward: User makes an initial deposit of a specified minimum amount.

- Third Reward: User sets up a recurring deposit or savings plan.

- Fourth Reward: User refers friends or shares the app on social media.

- Fifth Reward: User upgrades to a premium subscription.

Advantages:

- Initial Event Payout Can Be Decreased: Reduce the initial event payout and increase the deeper event payouts to increase LTV:CAC.

- Enhanced User Engagement: Encourages users to explore and utilize more features.

- Higher Lifetime Value (LTV): Promotes sustained interaction, increasing the revenue per user.

- Stronger Brand Loyalty: Builds a lasting relationship through ongoing rewards.

When to Use:

- Fostering Deep Engagement: Ideal when your goal is to encourage users to engage with multiple features over time.

- Increasing LTV: Use when aiming to boost the average revenue per user through continued interaction.

- Building Brand Loyalty: Effective for establishing a loyal customer base that actively promotes your app.

Key Considerations:

- Calculate Potential ROI: Weigh the cost of multiple rewards against the expected increase in user LTV.

- Optimize Rewards: Ensure that rewards are enticing but financially sustainable.

- Monitor Performance: Regularly analyze campaign data to adjust strategies as needed.

Balancing Costs and Returns

While multi-reward CPE campaigns may involve higher overall costs due to multiple payouts, the long-term benefits often outweigh these expenses. By:

- Continuously Re-engaging Users: You foster habits that lead to regular app usage.

- Increasing Revenue Streams: Encouraging users to engage with certain features boosts LTV.

- Reducing Churn Rates: Engaged users are less likely to abandon your app.

Selecting the appropriate CPE campaign type depends on your fintech’s specific goals and resources. Single-reward campaigns are excellent for targeting specific KPIs, while multi-reward campaigns are ideal for fostering deeper engagement. By carefully designing and continuously optimizing your rewarded UA campaigns, you can significantly improve your ROAS and drive sustainable growth.

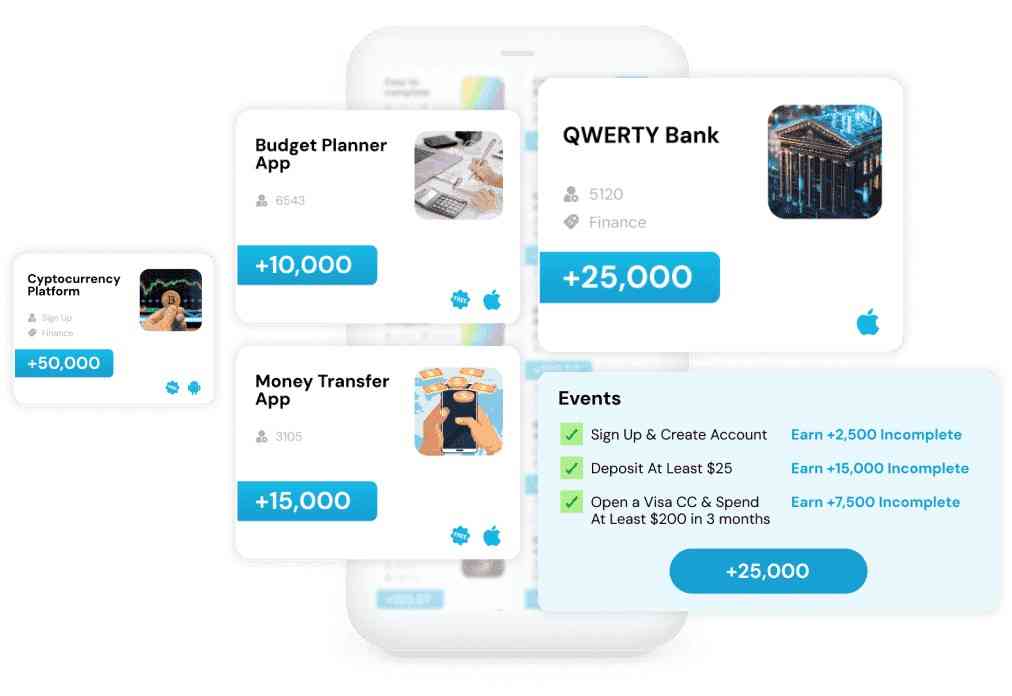

Example Rewarded UA Fintech Campaigns

At Adscend Media, we’ve delivered impactful results for fintech companies across various sectors, including investment, banking, cryptocurrency, payments, lending, and more. Below are several example rewarded UA campaigns modeled on actual initiatives that have generated significant results for our partners.

Well Known Bank

A well-known bank can deploy a single-reward CPE campaign to reward users who open a specific type of checking or savings account with a minimum deposit. In this case, the bank already has significant brand loyalty and extensive reach through other marketing channels that reinforce their messaging and support a clear Lifetime Value (LTV). By incentivizing account openings with a reward, they can efficiently acquire new customers likely to engage with their services.

Emerging Neobank

An emerging neobank can deploy a multi-reward CPE campaign to reward users for multiple actions:

- First Action: Open a checking or savings account with a minimum deposit to earn a reward.

- Second Action: Apply for and open a specific credit card offered by the bank.

- Third Action: Spend at least a specified amount (e.g., $500) on the credit card within a certain period.

- Fourth Action: Open a certificate of deposit (CD) account.

This multi-reward CPE campaign helps foster brand loyalty by encouraging users to engage with multiple financial products and services offered by the neobank.

Cryptocurrency Platform

A cryptocurrency platform can deploy a single-reward CPE campaign to reward users who open an account and make a minimum deposit. To take it a step further, a multi-reward CPE campaign can further reward users for additional actions, such as making their first trade on the platform.

By incentivizing these actions, the platform encourages users to actively engage with trading features, increasing user retention and transaction volumes.

Financial Planning Platform

A financial planning platform (e.g., investment planning, budget planner, money tracker, net worth tracker) can deploy a single-reward CPE campaign to reward users who subscribe to a free trial or paid subscription. With a multi-reward CPE campaign, the platform can further encourage interaction by rewarding users for:

- Second Action: Engaging with core features like setting up budgets or financial goals.

- Third Action: Linking financial accounts to the platform.

- Fourth Action: Continuing the subscription beyond the trial period.

In a world of short attention spans, this approach increases the likelihood that users become and remain paid subscribers by showcasing the platform’s value more effectively.

Payment/Money Transfer App

A payment or money transfer app can deploy a single-reward CPE campaign to reward users who:

- Set up an account.

- Complete Know Your Customer (KYC) verification.

- Add initial funding.

With a multi-reward CPE campaign, they can further reward users for:

- Second Action: Referring a friend who also completes the same actions.

This strategy not only increases user engagement but also leverages network effects to grow the user base cost-effectively.

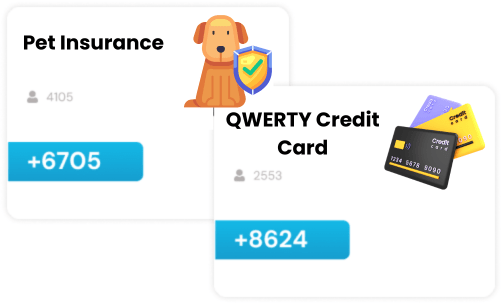

Insurance Platform

An insurance platform can deploy a single-reward CPE campaign to reward users who purchase a particular type of insurance plan offered by their platform. By offering incentives for plan purchases, the platform can attract new customers and encourage them to explore additional insurance products and services.

These examples showcase just a few ways that single-reward and multi-reward CPE campaigns can be tailored to meet the unique goals of various fintech companies. We understand that every business has its own specific objectives and challenges. That’s why at Adscend Media, we don’t believe in a one-size-fits-all approach.

Choose The Right Partner

While rewarded user acquisition offers significant benefits for fintech companies, it also presents unique challenges—particularly concerning compliance and fraud. Financial firms often view rewarded traffic with caution due to strict regulatory requirements and the risk of fraudulent activities. Choosing the right partner is essential to navigate these challenges effectively and maximize your return on ad spend (ROAS).

Navigating Compliance Challenges

Fintech companies must adhere to stringent regulations such as Know Your Customer (KYC), Anti-Money Laundering (AML) policies, and data protection laws like GDPR and CCPA. Non-compliance can result in hefty fines and damage to your brand’s reputation. It’s crucial to ensure that rewards are structured in ways that comply with these financial regulations and that users’ identities are verified appropriately.

Mitigating Fraud Risks

Fraudulent activities like fake account creation, bot traffic, and reward abuse can undermine your campaign’s effectiveness and inflate acquisition costs. Trusted incentivized traffic platforms utilize sophisticated fraud detection tools and secure tracking systems to identify and prevent such activities. By ensuring that rewards are only granted to genuine, high-quality users, you maintain the integrity of your user base and maximize your ROAS.

Test Rewarded UA

In today’s competitive fintech landscape, leveraging rewarded user acquisition strategies is an essential component of a successful marketing plan. By understanding and optimizing your Customer Acquisition Cost (CAC) and Lifetime Value (LTV), implementing effective single-reward or multi-reward Cost Per Engagement (CPE) campaigns, and partnering with the right experts, you can significantly enhance your Return on Ad Spend (ROAS). As the industry continues to evolve, staying ahead with innovative marketing approaches will position your fintech company for long-term success.

Contact us today to discover how Adscend Media can help your fintech company leverage rewarded UA campaigns to drive ROAS and achieve sustainable growth. With our proven track record and industry expertise, we’re ready to partner with you to navigate the complexities of rewarded user acquisition and propel your fintech business forward.

Add comment